When the fiscal year ends on September 30, the US Congress needs to approve 12 bills that fund the government or a temporary measure that extends the current funding. Otherwise, the government will run out of money and have to stop some or all of its non-essential operations. This is called a government shutdown, and it can happen if Congress and the president disagree on the budget or if the president rejects the funding bills. A government shutdown can affect many aspects of the society, such as the economy, public services, federal workers, and national security.

Investors are reacting to a possible government shutdown with a mix of caution and optimism, as it anticipates a temporary and limited impact on the economy and markets. However, investors are also closely watching the developments and negotiations in Congress and the White House, as any prolonged or unexpected outcome could change the sentiment and outlook.

Background to the on-going deterioration in fiscal discipline

Over the past decade (2010 to 2021), the US federal deficit has increased by ~$9 trillion[1], reaching a record high of $3.1 trillion in 2020. The ratio of debt (deficit)-to-GDP also rose from 8.7% in 2010 to 14.9% in 2020, indicating that the government’s borrowing and spending outpaced the growth of the economy. The main factors that contributed to the rising deficits were the 2017 tax cuts, the increased spending on defence, health, and social programs, and the emergency relief measures for the COVID-19 pandemic[2].

Since 2020, deficit spending has continued unabated and according to the White House, the debt to GDP ratio is projected to be ~101.8% in 2023[3]. This means that the total public debt will be about $26 trillion, which is more than the nominal GDP of the country. The Congressional Budget Office (CBO) also estimates that the debt to GDP ratio will be ~101.8% in 2023, based on its baseline scenario[4]. The debt to GDP ratio is projected to increase to ~106.7% in 2024, according to the White House. This means that the total public debt will be about $28 trillion, which is more than the nominal GDP of the country. The CBO also estimates that the debt to GDP ratio will rise to ~106.7% in 2024, based on its baseline scenario.

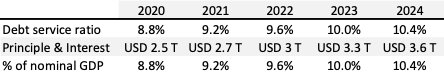

A related metric is the debt servicing ratio that measures the burden of servicing the public debt on the economy and the government’s fiscal capacity[5] – see table below.

Taken together, we should expect an imminent fiscal cliff and associated negative consequences for the economy, such as lower growth, higher unemployment, and reduced investor confidence. However, this outcome is unlikely, given the discipline associated with the debt ceiling has been temporarily suspended until January 1, 2025, allowing the Treasury Department to borrow more money to pay its bills and avoid a default[6].

Will a government shutdown occur?

In our judgement, such an outcome is unlikely for the following reasons:

- First, the president and Congress have a strong incentive to avoid a shutdown, as it can damage their public approval ratings and political prospects[7].

- A shutdown would reduce government revenue and economic growth, as fees are lost, and some furloughed employees receive back pay. Goldman Sachs economists have estimated that a shutdown would impact economic growth in the fourth quarter by 0.2 percentage points for every week it continues[8].

- A shutdown would undermine the credibility and reputation of the US government, both domestically and internationally. It would signal a failure of leadership and governance, and further erode public trust and confidence in the political system.

In conclusion, a US government shutdown is unlikely to happen because of the political and economic costs. There are still many challenges and uncertainties that could affect the fiscal outlook of the US, such as inflation, revenue shortfalls, spending pressures, policy disagreements, and unforeseen emergencies. It is important for the president and Congress to work together to ensure fiscal responsibility and stability for the nation.

Should you wish to discuss any of issues raised in the note, please do not hesitate to contact: Laurie Antioch, Chief Finance & Strategy Officer.

Loading

Loading