A GST course is designed to provide individuals with a comprehensive understanding of the Goods and Services Tax (GST) system in their country. The GST is a value-added tax that is levied on the supply of goods and services in most countries. The course is typically aimed at business owners, accountants, tax professionals, and other individuals who deal with GST in their work.

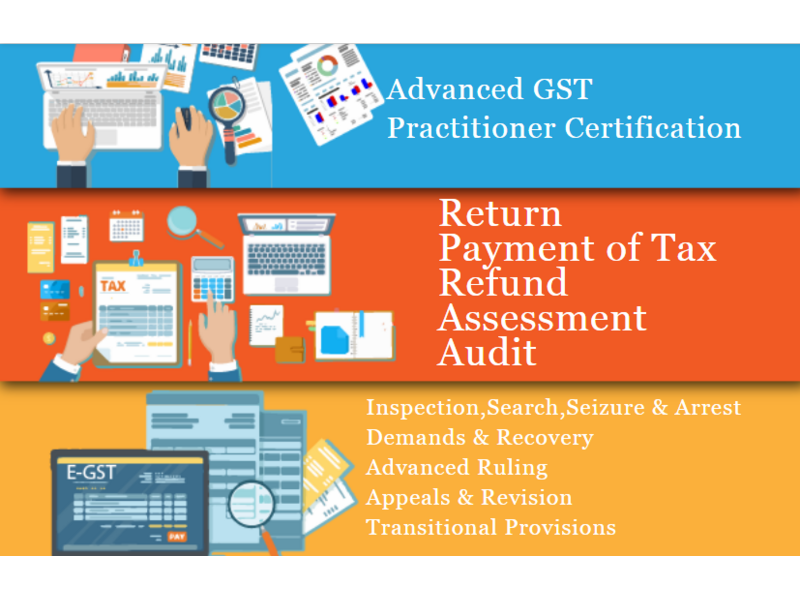

The GST Course in Delhi covers topics such as the basics of GST, registration and compliance requirements, invoicing and accounting for GST, and filing GST returns. It also provides an overview of the GST law and regulations, including the rates of GST, exemptions and thresholds, and input tax credits.

GST courses can be taken in person or online and usually last for a few weeks to several months. The courses may include lectures, case studies, and practical exercises to help individuals develop their understanding of GST and its practical applications in their business or work.

One of the key benefits of a Accounting Training in Laxmi Nagar, Delhi is that it provides individuals with a thorough understanding of the GST system and its requirements. This can help businesses and individuals ensure compliance with the law, avoid penalties and fines, and optimize their GST returns.

Another benefit of a GST course is that it equips individuals with technical skills such as GST calculation, invoicing, and record-keeping. These skills are essential for businesses and individuals who deal with GST in their day-to-day work.

Students who enroll a GST Certification in Delhi will also learn how to use GST software to manage their GST returns and compliance requirements. These software tools are widely used in the industry and can help individuals and businesses streamline their GST processes and save time and effort.

To make the most out of a GST course, students should have a basic understanding of accounting concepts and tax laws. They should also be familiar with the GST laws and regulations in their country and have a strong interest in staying up-to-date with changes and developments in GST.

Overall, a Accounting Institute in Laxmi Nagar, Delhi is a valuable investment for anyone looking to develop their skills and knowledge in GST and its practical applications in their business or work. The course can provide individuals with a competitive edge in the job market and prepare them for leadership roles in organizations that deal with GST.

SLA provides valid GST Training Course in Delhi, Ghaziabad, Noida, "SLA Consultants" Tally, SAP Certification, BAT Institute, and to get more details visit at:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/training-institute-accountancy-course/

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor,

Metro Pillar No 52

Vijay Block, Laxmi Nagar

New Delhi, 110092

Call: +91-8700575874

E-Mail: [email protected]

Website: https://slaconsultantsindia.com/

Loading

Loading